China's New Non-Life Insurance Regulation: Cash Before Cover

China's new regulation imposes a cash-before-cover rule in the non-life insurance market, but this change has wider ramifications. The regulation is part of a larger pivot in the Chinese market from competition on price and volume towards competition on service, quality, and brand.

Insights and Impact: Highlights from Axco Americas 2025

Nearly 200 insurance professionals gathered in Miami on November 20-21 2025, for Axco Americas - a dynamic two-day conference hosted by Axco Insurance Information. The event buzzed with energy as leading carriers, brokers, and corporate risk managers connected, shared insights and experience and explored some of the most pressing challenges in multinational insurance.

Understanding Brazil's New Insurance Act

A new Insurance Act comes into effect in Brazil in December 2025. It represents a significant update to the country’s insurance regulations, including revocation of previous regulations. Following a recent country visit, Axco's own researcher details what this means for reinsurers, insurers and brokers navigating Brazil's regulatory landscape.

Axco Navigator’s Summer Release

Axco Navigator took its first nascent steps in the Summer of 2024, providing the first of its kind, all-in-one multinational insurance data portal. From those early first steps, Navigator has grown from strength to strength growing both its functionality and data coverage. It now proudly boasts over 97% percent of global GWP, mapped to the line of business and company that wrote it, company financial and balance sheet data and much more.

Understanding Non-Admitted Insurance

Non-Admitted, what is it? The first thing you check when looking to place or write international insurance? Probably. More complicated than it first appears? Almost certainly. A key set of regulatory requirements that you have to understand if you operate in multinational insurance? Definitely.

Axco Global Insurance Week

This year marks an exciting milestone in our journey into the heady waters of events. Since our beginning three years ago, we’ve expanded geographically with the launch of Axco Americas this year and continue to host Axco Global Insurance Week in London. The reception to our events has been fantastic; we've seen a remarkable increase in attendance and participation, reflecting the growing enthusiasm and engagement from the community, and we feel exceptionally privileged to use our impartial position as an information provider to the multinational insurance market to bring the whole market together.

Ensuring Global Insurer Compliance: A Moving Target

In an increasingly interdependent global economy, insurance companies face an intricate web of legislative and regulatory requirements to manage their clients’ global insurance programs. Global insurance compliance is a necessity to mitigate risks, avoid legal action, and maintain a strong corporate reputation. To do so, companies need to be continuously vigilant and adaptable. This article outlines why compliance is critical and how global insurance companies can successfully navigate the complex global compliance landscape.

Flashpoints

Stay up to date with the latest risk news from around the globe by signing up for this monthly newsletter

Subscribe

Europe's Ageing Population and Pension Problem

Europe’s demographic landscape is shifting towards an increasingly older population. The continent, once benefiting from a demographic dividend, now faces a profound transformation, with ageing populations dominating. Alongside this ageing phenomenon, there is an increasing emphasis on old-age income support, driven by the significant demographic transition

Myanmar's Insurance Market Faces The Earthquake Challenge

The powerful earthquake that rocked Myanmar on Friday, has undoubtedly brought tragedy, with lost lives, homes, and livelihoods. Fresh from a country visit in early March Axco's 'man-on-the-ground' examines how prepared is the local insurance market to address this crisis.

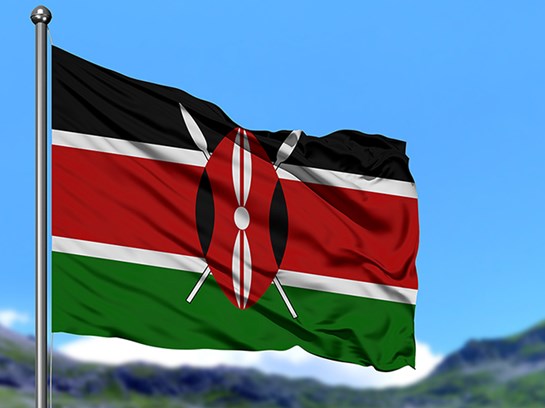

Kenya’s Life Insurance Market Continues to Grow

Kenya’s life insurance sector has demonstrated consistent double-digit growth, more than tripling its written premiums between 2013 and 2022. A recent market entrant has captured 8.7% of market share in two years.

Despite Strong Growth in the Catastrophe Bonds Market, Something Seems to be Missing

The catastrophe bonds (cat bonds) market, the vast majority of the insurance-linked securities (ILS), has experienced substantial growth in recent decades, driven by increased (re)insurer demand for alternative risk transfer solutions and investor appetite to diversify their investment portfolios. According to market statistics, cat bonds issuance increased more than sevenfold between 2003 and 2023. There is not just an increase in the number of cat bonds issued; coverage has also expanded from natural catastrophes to human-made disasters such as terrorism and cybersecurity events.

Is Argentina Open for Business?

Are you looking to expand your operations or international client base? If so, we may have some good news for you. Argentina has eliminated its PAIS tax, a 25% tax on the purchase of goods or services in a foreign currency.

Zambia: An Emerging Reinsurance Hub

Work as an Axco consultant takes you far and wide, and 2024 was no different for me. Bookended by visits to two neighbouring African nations - Angola in January, and recently Zambia as a pre-Christmas trip.