The end of 2023 and the first few weeks of this new year have seen numerous economic commentators begin to celebrate a so-called soft landing as the US Federal Reserve and other major central banks signal a likely pause in interest rate hikes, and economic data continues to show positive growth. US Treasury Secretary Janet Yellen, on 5 January, stated as much, saying that a soft landing in the US economy was underway, before adding that Americans should “feel good about their future prospects” in a new low inflation, high wage growth environment.

This sentiment, however, appears to ignore glaring inflationary headwinds. First, attacks by Yemeni rebels in the Gulf of Aden have increased overall shipping costs, demonstrated by increased marine premiums in the region, which, combined with disruptions in the Panama Canal, have wreaked and will continue to wreak havoc across global supply chains.

Separately, oil prices have dropped by around 18% since the October 2023 spike, but they have largely stabilised since December 2023 and are unlikely to continue to trend downwards, given efforts by major oil producers to maintain production cuts. Lastly, consumer and business expectations remain subdued, leading many to adopt a ‘buy now, less prices rise later’ attitude.

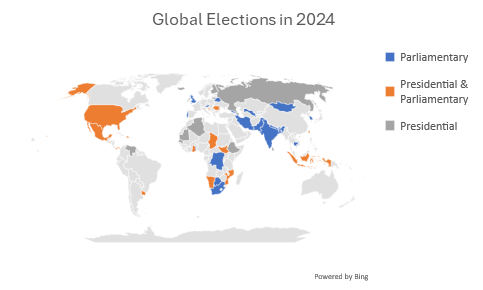

This will likely produce a ‘higher for longer’ inflationary environment that will have political and social consequences, particularly in countries where consumers will be flocking to the ballot box. Around 68 countries are scheduled to have elections in 2024, including major markets such as India, Indonesia, Mexico, South Africa, the UK and the US. How much economic factors impact voting results varies by region, and the extent of any economic shock is felt by a consumer.

However, as seen between 2008 and 2014 in North America and Europe, incumbents tend to pay a heavy price for poor economic performance. In France, the downfall of Nicolas Sarkozy in 2012 and the rise of Francois Holland were in part attributable to economic volatility. Similarly, in Canada, the collapse of the Conservative Party and the government headed by Stephen Harper in 2015 was linked to years of stagnant economic growth and the 2008 crisis. This trend continues to resonate today as well. In the UK, for example, the opposition Labour Party is currently seen as the party which would ‘best handle the economy’,

In countries where incumbents have monopolised the political environment or elections are a matter of formality as opposed to a legitimate contest, the electoral period can still catalyse the second consequence of high inflation: domestic unrest. According to the Carnegie Endowment for International Peace Global Protest Tracker, economic issues have been the main driver of around 37% of all protests tracked by the group since 2017. The number jumps to 44% when filtering for active protest movements. In 2022-2023, there were spikes in unrest directly associated with the cost of living and a rise in energy prices in France, Germany, Romania and the Czech Republic. There is no evidence to suggest that the domestic unrest will not resurface in 2024.

Both an uptick in political instability driven by electoral turnover and domestic unrest will impact providers and consumers of political risk insurance. Insurers may be forced to adjust premiums or coverage terms based on the elevated risk environment. For customers, this may mean higher premiums and stricter terms. This does not mean lower demand for political insurance cover, though. In the World Economic Forum’s (WEF) Global Risks Report released on 10 January, most participants polled on the emerging risk environment felt that the global outlook for 2024 was likely to be precarious, marked by escalating societal polarisation and geopolitical tensions.

The WEF report warned that geopolitical tensions may lead to fragmented governance in many areas of the world, hindering global cooperation on pressing issues such as climate change. It also stressed that the near-term outlook for key global growth markets – namely China – remains cloudy, suggesting that current forecasts for growth in many countries could be substantially altered if the situation in China turns for the worst.

Notably, the report polled previous Davos participants in September 2023, before the war in the Middle East. If conducted today, the poll would surely show a further depressed and downbeat forecast.

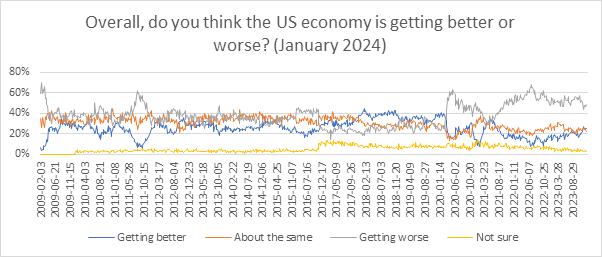

So, is talk about a soft landing premature? Likely. Consumer inflation data in both the US and the UK for December 2023 delivered worse-than-expected readings. This is not to say that a return to 2022-2023 inflation levels is on the table, but inflationary pressures rarely recede in a matter of months. In the early 1980s, it took about 2-3 years for the Federal Reserve under Paul Volker’s tight monetary policy to reduce high inflation significantly. In the meantime, assuming Central Banks stay the course and do not begin to cut rates, an elevated risk environment – featuring intermittent spikes in protests and labour actions as well as the possibility of some political newcomers entering the scene – will need to be factored into firms’ economic forecasting.

Axco is the leading supplier of global insurance market information with over 55 years’ experience in researching and publishing industry intelligence on insurance and employee benefits. Its unique business model and methods of research have enabled the development of an extensive suite of products comprising in-depth reports, focused profiles, Q&A databases, intelligent questioning tools, and email services which are delivered to every corner of the globe.