Home

//

Thought Leadership//

The Bab el Mandeb Strait and Panama Canal: Disruption to Global Supply Chains

Entering 2024, an unavoidable feature of geopolitical analysis has been the disruption facing two of the world’s key maritime chokepoints, the Bab el Mandeb Strait and the Panama Canal. Troublingly for shipping and the global economy, no near-term solution is in sight to resolve the disruption at either of these shipping lanes.

The threat posed by disruption to key maritime chokepoints is well established. Analyses of the potential consequences of a military escalation involving Iran have typically emphasised the potential risks to oil and the Strait of Hormuz. At the same time, the Russo-Ukrainian War has led to a focus on the supply of agricultural products out of the Black Sea via the Bosporus Strait.

The Bab el Mandeb Strait is a chokepoint south of Egypt’s Suez Canal, situated between the Gulf of Aden and the Red Sea, which sees an estimated 12% of the world’s maritime trade flows. The Yemen-based Houthi movement has capitalised on this bottleneck since November 2023, staging numerous attacks against civilian and military vessels as an apparent retaliation to US support for Israeli operations in Gaza.

The Houthis have effectively closed the strait by elevating security costs to firms, as is evident by the skyrocketing hull and cargo insurance premiums. Consequently, global shipping firms, including Maersk and CMA CGM, have been driven to divert freight through the Cape of Good Hope.

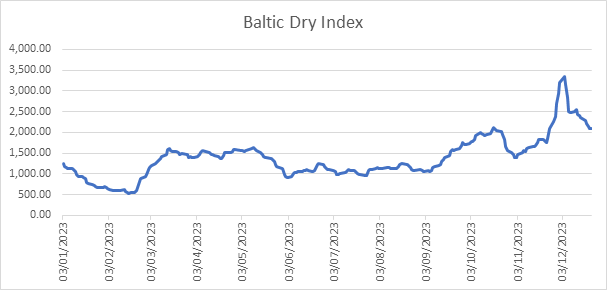

The Baltic Dry Index is a benchmark for the price of moving major raw materials by sea. Source (https://tradingeconomics.com/commodity/baltic)

Commenting on the new risk environment in the Red Sea, Martin Tomlinson, an International Insurance Consultant at Axco, noted that “premiums will likely stay high in the Red Sea area for some time. For me, it brings to mind the Somali piracy situation (…) it can go on for years”. Complicating the situation is that no international government is likely willing to act as a financial backstop for private firms in the Red Sea by covering elevated insurance costs. John Byrom, a separate International Insurance Consultant at Axco, said he was highly sceptical of the prospect of any state moving to act as Israel did for domestic routes following the 7 October attack by Hamas.

When forecasting future developments on the Bab el Mandeb Strait, some key differences must be noted between the Houthi threat to maritime freight and that of Somali piracy in the early 2010s. Somali piracy declined after the mid-2010s due to the adoption of transit corridors, the emergence of private maritime security firms which deterred boardings, and a significant Western naval presence.

The applicability of these lessons is questionable, given that the Houthis can achieve their goal by simply disrupting maritime freight flows rather than destroying or capturing vessels. The Houthis are largely being supplied by Iran, which remains unaffected by the disruptions and sees attacks on marine freight as a low-cost, high-reward strategy of inflicting pain on the US and other Western nations.

US and UK air strikes against Houthi targets in Yemen are unlikely to disrupt their ability to launch these attacks or successfully deter future action. This was demonstrated by years of strikes by Saudi Arabia, which did little to change the course of Yemen’s Civil War.

The US coalition will face the same challenge that Saudi Arabia did, in not being able to directly target the source of Houthi capabilities in Iran without risking a regional escalation. Ultimately, the most likely scenario is that unless an agreement is brokered with Iran and the Houthis, the threat posed to shipping in the area will persist and become an entrenched feature of the regional security environment.

The emergence of additional theatres of risk in the Middle East and East Africa also presents threats. South of Bab el Mandeb, there has been a resurgence in maritime piracy, with Somali pirates in December 2023 carrying out the first successful hijacking of a vessel in the area since 2017. Both raise the prospect that even if Houthi attacks disappear, shippers will continue to incur increased costs for operating in the wider area.

Compounding the challenges facing shipping in the Middle East are developments facing the Panama Canal in Central America, which handles around 5% of global shipping. Low water levels, caused by the El Nino weather phenomenon and high surface water temperatures in the North Atlantic, have resulted in unprecedented restrictions on the number of ships moving through the canal.

Currently, around 24 vessels per day are allowed to traverse the canal, down from an average of 36, forcing many shippers to take the alternative route down South America’s Atlantic coast before crossing the Strait of Magellan. The challenges facing the Panama Canal are likely transitionary. Still, any positive resolution depends on a significant rainy season in the second half of 2024 or, ultimately, the construction of a new reservoir.

International trade has endured prior sustained disruptions to maritime chokepoints, such as with the total closure of the Suez Canal between 1956 and 1957 or 1967 and 1975. The significance of the current moment comes from the threat of sustained disruption at the world’s two key maritime chokepoints occurring simultaneously. This raises the prospect that the current crises at the Bab El Mandeb Strait and the Panama Canal will result in an unprecedented and enduring level of impact on supply chains, causing significant political and economic repercussions globally.

Axco is the leading supplier of global insurance market information with over 55 years’ experience in researching and publishing industry intelligence on insurance and employee benefits. Its unique business model and methods of research have enabled the development of an extensive suite of products comprising in-depth reports, focused profiles, Q&A databases, intelligent questioning tools, and email services which are delivered to every corner of the globe.