South Africa’s 2024 general election will be among the most significant in its democratic history. The African National Congress (ANC) has governed the country from a position of unassailable electoral strength since Nelson Mandella first led it to victory in 1994. Now, it’s on the brink of losing its majority in parliament. This would force President Cyril Ramaphosa to form the country’s first coalition government to stay in power and his choice of political partner could have a significant impact on the country’s future direction.

The ANC’s fall in popularity has been dramatic. A stagnating economy, decaying public services and pervasive political corruption have dragged its support to below 40% in some polls, a drop of almost 25% over ten years. South Africa’s unemployment rate, sitting at 32%, is the highest in the world, while its per-capita murder rate has reached a 20-year high. Growing public anger in response to these issues has created an opening for political opponents.

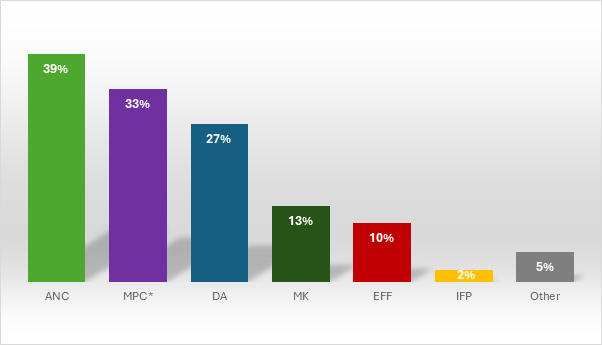

*Pools votes of DA, IFP, ASA, FF+, ACDP and others

Source: Brenthurst Foundation, March 2024

The impact of corruption on public services has accelerated the government’s sliding popularity, most visibly in the case of state-owned electricity producer Eskom. The company has struggled with undercapacity since the transition from apartheid, designed as it was to provide a reliable service to fewer than 15% of the population. Decades of underinvestment and endemic graft have since hollowed it out to the extent that it now struggles to function at all. Planned power cuts of up to 12 hours to prevent the electrical grid from collapsing are common, damaging businesses of every size while facilitating an already high crime rate.

One advantage the ANC holds is a fractured opposition, providing plenty of options if it has to make a deal in May. A coalition led by the centrist, economically liberal Democratic Alliance (DA) has failed to coalesce around a single candidate. The DA is considered the most business-friendly of the main parties and has declared itself open to talks with Ramaphosa. It also seeks to block the ANC from partnering with the populist Economic Freedom Fighters (EFF).

Led by Julius Malema following his expulsion from the ANC's Youth League, the EFF presents itself as a more radical, anti-capitalist alternative to the ANC. It is primarily known for mobilising anti-government protests, particularly among the young, intimidating journalists and opposition politicians, as well as the frequency with which its MPs are ejected from parliament for disorder. It would prove a risky coalition partner for Ramaphosa. Its programme of land seizures and the nationalisation of mines and banks would spook equity markets and panic foreign investors. Its support for arming the Russian military would also create tensions with South Africa’s Western allies.

An ANC-EFF coalition would also deepen the ANC’s own internal divisions, which peaked with former president Jacob Zuma’s formation of a rival party, uMkhonto we Sizwe (MK). Pointedly named after the ANC's former paramilitary wing, MK threatens to further erode the government’s support, particularly in Zuma's home state of KwaZulu-Natal, where he remains highly popular. It also raises the risk of political violence between MK and ANC supporters in the event of a close vote.

An outbreak of violence in KwaZulu-Natal following Zuma’s arrest for corruption in 2021 snowballed into the most destructive episode of national unrest since the end of apartheid. The targeting of critical highways halted the movement of goods through Durban port, one of the busiest shipping terminals on the continent. A recent spike in political assassinations across the province has already raised local tensions in advance of the vote. A repeat of 2021’s unrest would potentially disrupt regional supply chains and cut off national food and fuel deliveries, risking a broader escalation in affected parts of the country.

The broader implications of a coalition government depend on how far below 50% the ANC’s vote share falls. A deal with a small party would see minimal differences, while a larger, more assertive one would likely demand greater policy shifts. Of the latter, a deal with the DA is likely to provoke the most positive market reaction and the EFF the most negative. Even with a more passive coalition partner, it won’t be business as usual, as the opposition will have far greater latitude to challenge the government over legislation if it wins control of key provinces and economic centres.

A coalition would also break the ANC’s exclusive hold on foreign policy. This will have limited impact on South Africa’s local region due to Pretoria’s stable relations with its neighbours, but it could complicate its ties with illiberal countries such as China and Russia. A majority of voters believe China interferes in South African politics, while the ANC’s tacit support for Russia in the Ukraine war and its historical affinity with Palestinian armed groups are not shared by many of its prospective coalition partners.

The shock of ANC’s diving popularity has already seen it take corrective action. The lifting of restrictions on how much electricity the private sector can supply promises to improve the business environment while opening the door to greater green energy investment. The threat of further drops in public support could force the ANC to address other longstanding problems more actively, such as crime and unemployment, particularly if a coalition partner prioritised these issues. A power-sharing arrangement will also present risks to government stability, regardless of the ANC’s choice of partner. Coalitions are common in South Africa at the ward level and have a consistent history of failure. The introduction of one at the national level will introduce an unprecedented degree of political uncertainty.

Axco is the leading supplier of global insurance market information with over 55 years’ experience in researching and publishing industry intelligence on insurance and employee benefits. Its unique business model and methods of research have enabled the development of an extensive suite of products comprising in-depth reports, focused profiles, Q&A databases, intelligent questioning tools, and email services which are delivered to every corner of the globe.