Heightened Competition in Swedish Market

Sweden’s insurance market is becoming increasingly competitive, and premiums will be hard-won. In 2022, the Swedish insurance industry comprised of 195 non-life insurance companies, including those companies operating under freedom of services.

Although there are many non-life insurance companies, the market is undoubtedly top-heavy, with the top four insurance groups dominating the market. However, there is a possibility of a shake-up happening over the next years, as several new participants have entered the market, and there is increased competition for both commercial and retail insureds.

One development which is starting to challenge market leaders is the establishment of an insurer by ICA, one of Sweden’s leading supermarkets. With a client base of four million loyalty card holders, the company has been slowly building up a significant share in the private lines market segment.

Moreover, a particular feature of the Swedish insurance market is the use of captives. Over 130 captives have been established by Swedish enterprises, and few captives have even been set up by local municipalities.

In recent years several small insurers have been set up to operate in niche areas such as creditor (inkomstforsakring) and extended warranty insurance, further increasing the diversity of options for insureds in Sweden.

With the amount of options available, we could be on the verge of serious change in the Swedish insurance market. Especially if more companies like ICA with the resources, branding and customers to take on the current juggernauts at the top of the market join the fray.

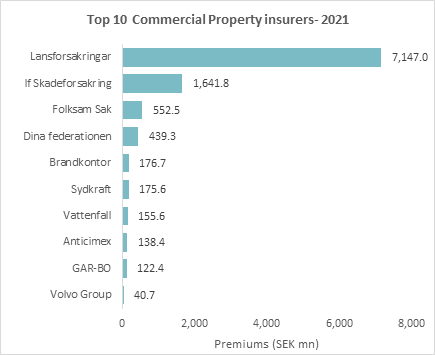

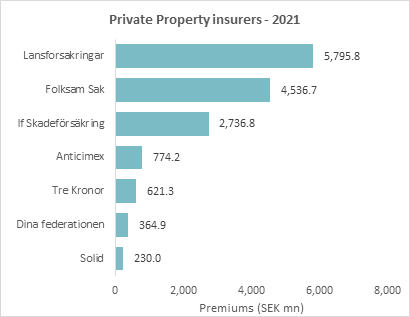

Axco’s Insurer Performance dashboards show the insurer ranking split between commercial and personal property insurers in 2021. The rankings illustrate that despite new entrants into the market, the largest group still dominate both the commercial and private property markets.

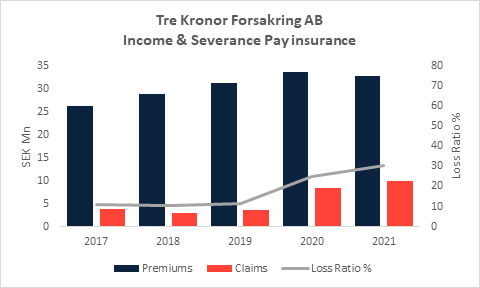

Tre Kronor Forsakring AB ranks as the third largest income and severance pay insurer in Sweden. The below chart is taken from Axco’s Insurer Performance data dashboard.

Tre Kronor Forsakring AB ranks as the third largest income and severance pay insurer in Sweden. The below chart is taken from Axco’s Insurer Performance data dashboard.

About Insurer Performance Dashboards

Axco’s Insurer Performance dashboards provide you with a simple and quick way to analyse which insurers operate within a territory. With granular details available from information on loss ratios to which insurers dominate certain lines of business.

Whether you are looking to find new markets to place business with or trying to analyse new opportunities, Axco’s data dashboards can give you the strategic information you need to identify and capitalise on international opportunities.

Axco’s data dashboards cover nearly 60 international markets, with consistent additions to the dashboards based on market research and customer feedback.

Find out more here: https://www.axcoinfo.com/products/data-dashboards/

To find out if our data dashboards cover the markets you need, contact us at axco@axcoinfo.com

Axco is the leading supplier of global insurance market information with over 55 years’ experience in researching and publishing industry intelligence on insurance and employee benefits. Its unique business model and methods of research have enabled the development of an extensive suite of products comprising in-depth reports, focused profiles, Q&A databases, intelligent questioning tools, and email services which are delivered to every corner of the globe.